See irs publication 5271.

Macrs life carpet.

System macrs for carpeting in a rental apartment over a 5 year period.

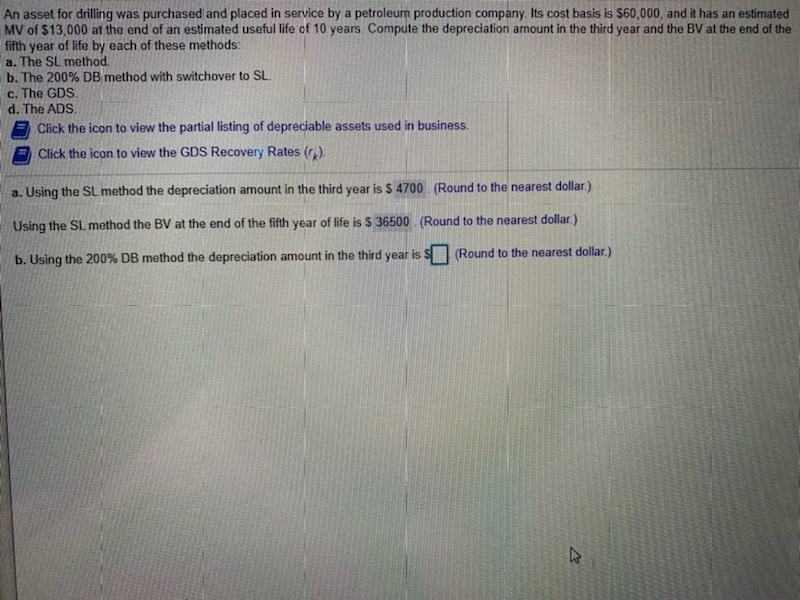

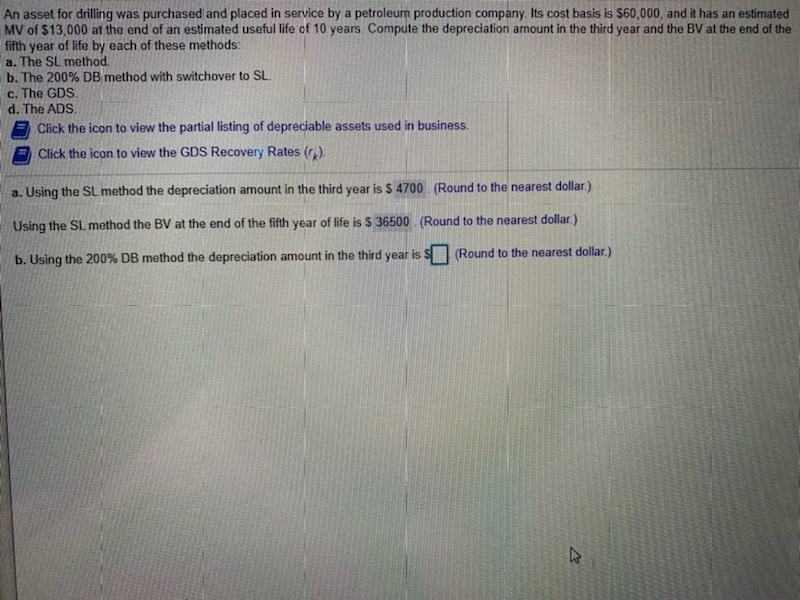

Each item of property that can be depreciated under macrs is assigned to a property class determined by its class life.

The property class generally determines the depreciation method recovery period and convention.

If the carpet is glued down perhaps in a basement then it becomes attached to the property and must be depreciated over 27 5 years.

The modified accelerated cost recovery system macrs is used to recover the basis of most business and investment property placed in service after 1986.

Macrs aims to maximize deductions using accelerated depreciation schedules to encourage capital investments not to accurately reflect the use of the asset over its useful life on the financial statements.

Thus if the class life of carpet e g is more than 4 but less than 10 years the landlord depreciates carpet over 5 years because it is 5 year property.

The table specifies asset lives for property subject to depreciation under the general depreciation system provided in section 168 a of the irc or the alternative depreciation system provided in section 168 g.

Macrs depreciation schedules are only used for income tax reporting not financial reporting.